The Connection Between Where You Live and What You Pay

One of the most common surprises for policyholders is discovering that their insurance premium changes after moving, even if their driving habits or lifestyle stay the same. The reality is that insurance companies calculate risk in part based on where you live. A change in postal code can impact your premium because it signals different risk levels tied to your new neighbourhood, even if it’s only a few blocks away.

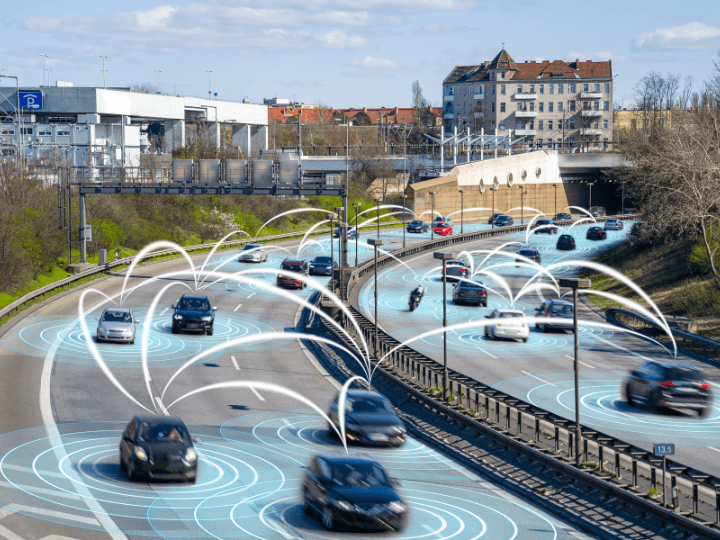

Auto Insurance: Local Risks Matter

For auto insurance, insurers use postal codes to assess the likelihood of accidents, theft, and claims in a particular area. If you move from a quiet suburban neighbourhood to a busy urban core, your premium may increase because urban areas typically see more collisions and vehicle thefts. Conversely, moving to a smaller town or rural area could lower your premium if the risk of accidents and theft is statistically lower there.

Postal codes also influence repair costs. If your new area has higher labour or repair shop rates, that can factor into your premium as well. Even weather patterns, like heavy snowfall or frequent hail, play a role in location-based risk assessments.

Auto Insurance: Parking and Commuting Considerations

Beyond neighbourhood statistics, your postal code also affects where and how your vehicle is stored. Insurers often ask if your car is parked in a garage, driveway, or on the street, and these details can influence rates. For example, a vehicle kept in a locked garage in a residential area may be considered lower risk than one parked on a busy downtown street.

Your commute matters too. Moving closer to work might shorten your daily driving distance, potentially lowering your premium. On the other hand, relocating to a suburb that requires longer commutes could increase your risk of accidents, which insurers will factor into your rate. Even something as simple as switching from residential to highway-heavy driving can change your risk profile.

Home Insurance: Location Shapes Exposure

With home insurance, postal codes are equally important. Insurers look at the risk of fire, flood, theft, and other perils associated with your location. Moving to a neighbourhood with older infrastructure, for instance, might raise concerns about plumbing or electrical issues. If your new home is in a flood-prone zone or near areas with a higher crime rate, your premium may increase to reflect those risks.

On the flip side, moving to a newer development with updated building codes and lower crime rates might result in savings. Proximity to fire hydrants, fire stations, and even the distance from large bodies of water can all influence your premium.

Why Neighbourhoods Matter

It can be frustrating to see your rate change after moving only a short distance, but insurance is all about statistics. Insurers group data by postal code to identify patterns. If one area shows a higher frequency of claims, everyone in that area is considered higher risk – even if you personally have never made a claim. It’s less about individual behaviour and more about the collective data tied to your new location.

What You Can Do as a Policyholder

While you can’t change how insurers calculate risk, there are steps you can take to keep your premiums manageable after a move. Reviewing your policy with a broker is a good place to start. They can confirm whether you’re getting all eligible discounts, such as bundling home and auto coverage or installing safety features like alarm systems.

It’s also a good idea to notify your insurer well before your move. This gives you time to understand how your premium will be affected and to shop around if needed. Each insurer weighs risk factors differently, so a broker can compare options and help you find a policy that fits your new circumstances.

_

Your postal code plays a bigger role in your insurance premium than you might think. Moving to a new neighbourhood changes the risk profile insurers use to calculate rates, whether it’s tied to accidents, theft, repair costs, or environmental hazards. While these adjustments can sometimes be frustrating, they ensure that premiums reflect the realities of your location.

If you’re planning a move, don’t wait until after you’ve settled in to check on your coverage. Speak with your broker in advance to understand how your new postal code will impact your premium, and to make sure you’re still getting the best protection for your needs.