When it comes to home and auto insurance, many people focus on the obvious factors: the size of their home, the age of their car, or the amount of coverage they choose. While those elements matter, insurers also consider less obvious personal factors that can significantly affect your premiums. Among the most influential are your credit score, driving record, and home security measures. Understanding how these elements impact your insurance rates can help you take proactive steps to save money and ensure adequate coverage.

Credit Score: More Than Just a Number

Your credit score does more than determine your eligibility for loans; it also plays a role in insurance. Insurers use credit-based insurance scores to predict the likelihood of a claim. Research has shown that individuals with higher credit scores tend to file fewer claims, which translates to lower risk for insurance companies.

If your credit score is lower, your premiums may be higher, even if you have a clean claims history. On the flip side, improving your credit score over time can have a positive impact on your insurance rates. Simple steps like paying bills on time, reducing debt, and regularly checking your credit report for errors can help improve your score and potentially reduce premiums.

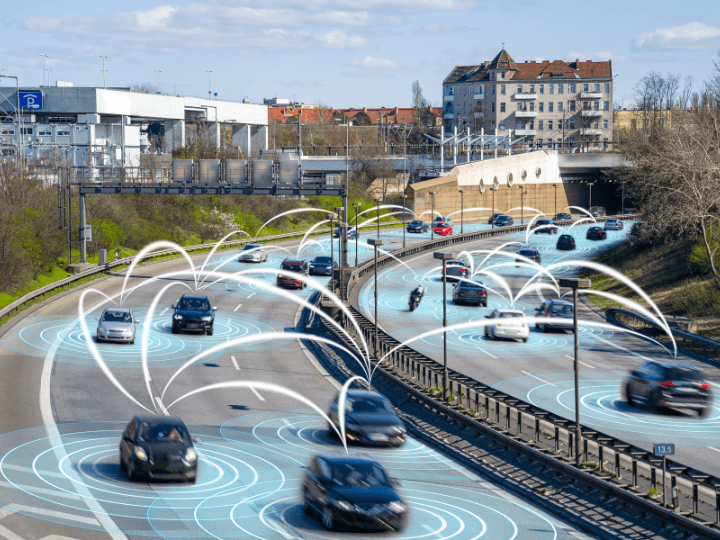

Driving Record: Your On-Road Reputation

For auto insurance, your driving record is one of the most critical factors. Accidents, traffic violations, and claims history all signal your risk level to insurers. Even minor infractions, such as speeding tickets, can increase premiums.

Maintaining a clean driving record demonstrates responsibility and reduces the likelihood of costly accidents. Defensive driving courses can also help; many insurers offer discounts to drivers who complete approved programs. Safe driving doesn’t just save lives, it can save money too.

Home Security: Protecting Your Property

Home insurance premiums are influenced by the level of security and safety features in your home. A property equipped with smoke detectors, deadbolt locks, alarm systems, or monitored security cameras is seen as lower risk. Insurers recognize that well-protected homes are less likely to suffer theft, fire, or other damages.

Beyond reducing premiums, investing in home security provides peace of mind and can enhance overall safety for your family. Simple improvements, like upgrading door locks or installing motion-sensor lighting, can make a difference when it comes to insurance rates.

Why These Factors Matter Together

Insurance companies aim to balance risk with the premiums you pay. Your credit score, driving history, and home security measures each provide insight into your overall risk profile. By addressing these areas, you can make yourself a lower-risk client, which may translate into savings across both home and auto policies.

For example, a homeowner with a strong credit score, advanced security features, and a safe driving record could qualify for bundled insurance discounts or lower rates across multiple policies. On the other hand, ignoring these factors can lead to higher premiums, even if your home and car themselves are low-risk.

Take Control of Your Insurance Costs

While some factors, like your credit score or driving history, may take time to improve, you can start today by enhancing home security and reviewing policy options. Regularly updating your information with your insurer ensures they accurately assess your risk, which could lower your premiums.

Working with a knowledgeable insurance advisor can also help you understand how these personal factors impact your rates and explore strategies for savings. Whether it’s bundling home and auto policies or recommending security improvements, an advisor can tailor a plan that fits your needs and budget.

_

Your credit score, driving record, and home security are more than background details – they directly influence your home and auto insurance rates. By understanding and addressing these factors, you can take control of your premiums while protecting your property and vehicles. Contact us today to review your policies and find ways to maximize your savings and coverage.